"Which one of you is going to be doing the fundraising?" queried a calm and collected Tom Robinson while in a loud venue one Saturday evening at a Startup School after-party. Tom had good reason to be relaxed that evening. His startup, 280 North, had been acquired by Motorola for 20 Million a few months prior. I had just shared that my co-founder Chad and I were just getting started with fundraising for Notifo. "Oh, we both are," I stuttered before gulping my drink. "Good luck!," he replied. I had no idea what the next months had in store.

Note: This post is intentionally vague. Perhaps one day, after an arbitrarily long epoch, I can divulge much more interesting details. For those not familiar with Notifo, it is a mobile notifications platform that makes it easy for developers to send push notifications without having to develop their own native mobile apps. It went through Y Combinator's Winter 2010 batch, officially launched in March and had a revamp in September.

Check out a great discussion of this post on Hacker News

I had always heard that fundraising was a pain in the ass and can often come close to killing a startup. If you haven't read the essay linked below by Paul Graham, it's definitely worth a read. Everything in that essay rings true.

But although for most startups raising money will be the lesser evil, it's still a pretty big evil—so big that it can easily kill you. Not merely in the obvious sense that if you fail to raise money you might have to shut the company down, but because the process of raising money itself can kill you. Paul Graham

For Notifo, it was the latter — the fundraising process itself. We weren't desperate — we had money thanks our utter frugality and a friends and family round we completed early in the summer. No office, few expenses1, and no salary2. Notifo had made significant strides in traction3 since launch and we felt that by getting a jump on the fundraising process we would be able to hire and grow quickly. The push space is still in its infancy and there has yet to be a clear and defined 800lb gorilla. There are several known companies working with push, each combatting different aspects of the same business. It was still a race, or so we thought.

Getting Started

We were set on fundraising. But how much? I've since learned that saying how much you want to raise is a bit of a game. You could say you're looking for 300K but then really want 500K and bank on being oversubscribed, et cetera. Stating you want a larger amount doesn't help you out when prospective investors tell you to keep them in the loop and let them know when you've already raised some portion of your round. That's why PG suggests not answering the "How much are you trying to raise?" question and being flexible. The amount we wanted to raise changed throughout our fundraising process. Initially we did not want to raise too much — just increase our runway and stay lean — but then some investors convinced us that now is the time to raise a bunch and move fast.

Team Notifo in-between Skype calls with prospective investors.

Team Notifo in-between Skype calls with prospective investors.

We updated our executive summary and made the first draft of a deck in Keynote. We got our story and angle down. We were raising to focus on problem X to cater to market segment Y with business model Z. We were the I for J. Nothing could stop us. We were going to win. Raising money would just get us there faster.

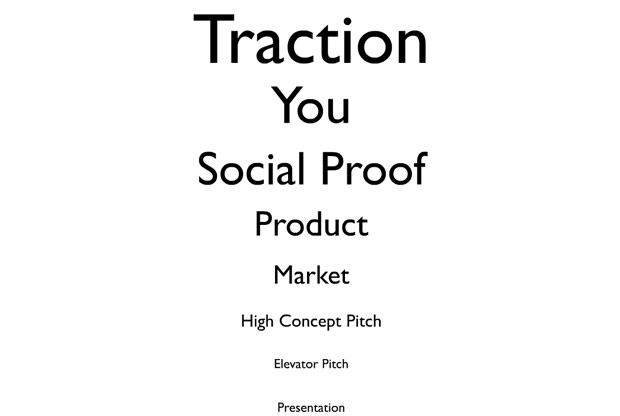

From a talk by Naval Ravikant - Before you raise money

From a talk by Naval Ravikant - Before you raise money

Notifo is a very technical startup at the outset — a mobile notifications platform. What does that even mean? How were we going to distill this into a few key points that all types of investors were going to understand? We latched onto a few things:

-

- developing mobile apps is a PITA and not feasible for the market we were targeting

-

- SMS is expensive

-

- our push implementation provides a richer experience than SMS

The next step was finding relevant investors that were willing to listen to us. The structure of our round was going to be done with convertible notes4, similar to our small F&F round in the summer. On the grand scheme of things, this aspect of fundraising was not the hardest. It just required a lot of repetition and emailing. A lot of emailing. We had a few amazing resources to help us out: Y Combinator, dedicated angels that came in during our F&F round, and AngelList.

The Grind

We got a large number of investor intros through trusted connections. We did our research on each investor before reaching out and chatting with them; sometimes even reaching out to their portfolio companies to get a sense of how the investor worked. While there is something to be said about having investors that prefer a hands-off approach, we have also learned that having investors that have the time to take a call or have lunch with you whenever you need advice is extremely beneficial. One of our angels, Gabor Cselle, took us out to dinner and noticed we weren't as chipper as we usually were, thanks in no small part to this fundraising mayhem. He insisted that we all go gokarting so Chad and I could clear our minds. We went and had a blast. Another one of our angels, Harj Taggar, has always been extremely easy to get a hold of. It could be the oddest hour but Chad and I had a burning question to get an outside opinion on so we'd just click the call button on Skype and he would magically appear with the wisdom we were looking for.

It's great to have a strong connection with our investors. They know exactly what is going on with the company. As such, we were looking for angels with some mixture of experience in product development, platform creation, mobile and running a technical startup. AngelList proved immensely helpful in this regard. It lets entrepreneurs easily see what kind of background investors have and their past investments. We chatted with Naval, he approved our application, helped us clean it up and then sent it out.

We got past the first few emails with about 40 investors and had at least one initial call, Skype or meeting with them. Several didn't reply to our first forms of contact, and we probably could have gotten in touch with them had we been more pushy5. There were several investors we internally dubbed the "untouchables" — investors you hear about everywhere and it doesn't matter how many amazing connections you have but you just can't get a hold of them. We got somewhere around 5 different intros to a few of those, from everyone ranging to some of their portfolio companies to other angels. Nothing. In hindsight, perhaps we should have realized we were spinning our wheels going after those big names.

This period of our fundraising process was the most lengthy and depressing. We just couldn't get much work done. We had several calls/meetings per day and the time left in-between was not suitable for getting wired in and coding. We were too distressed thinking about the fundraising.

In the middle of fundraising we got some great advice from people like Hiten Shah and Tim Ferriss. Our lunch with Hiten was inspiring and the guy is a straight-up riot. Hiten, an Internet friend I first met along with Neil Patel while interning in California in 2006, is the founder of KISSmetrics. He taught us things like how to deal with investors that don't understand your product or space:

This is a new technology and not everyone gets it

and to look at companies X, Y, and Z in the space.

He told us how to explain trends we were seeing to investors: Mobile web/HTML5 apps are the next big thing. Not everyone is going to have their own mobile native apps; many will have HTML5 apps and need to integrate with services like Notifo to access functionality of the host OS.

He also said how to reply to investors that wanted to see more traction:

That's okay. We're looking for early-stage investors that are ready now.

And then how to deal with many customers that keep asking for certain small features/updates:

Don't fix it until you get one passionate user complaining about it/emailing you an essay.

With each new pitch, we heard the same comments from investors. We had prepared for these and provided the best answers we could each time. Questions usually sprung up around our distribution model, our thoughts about the market and thoughts on getting around the barrier to entry (users must install the app). Some investors asked for things like our viral coefficient and our pro forma; we knew those were not the kinds of investors we were looking for. Other investors saw this as platform play with certain network effects (the more services signed up, the more benefit to users etc) and asked us if they could speak to our biz dev team — to which we informed them it was just the two of us.

Describing a technical platform only gets you half of the way there when trying to explain it to investors. You have to have simple, concrete use cases; ones that are currently out there as well as use cases that your platform could support. Speaking of technology, a rare few investors were highly technical and asked us about our infrastructure. That's when our faces lit up and we could get nerdy about how everything was built in-house and how much we love redis, which lets us do cool things like because it's stupid fast.

The hardest part is not hearing back. They would say they would get in touch next week, but nothing ever came. With a few notable exceptions of firms that got back to us quickly, many angels had to be reminded or emailed once a week. Sometimes they would ask for additional info about our convertible note specifics and would return with a commitment, or not and ask us to keep them in the loop with regards to the round's status. Other times we had a Skype video chat with someone overseas on a Saturday morning and they would say they're in and ask for our bank account number the next day. And then there were cases where people were interested but did not like that we were doing a convertible note round. Investors can be interested and just not get back to you in a timely fashion; they're busy people and it's your job to (politely) stay on top of them. Talking with other startups it seemed to be the norm that they would try to get a hold of them once a week if they had not responded by the time they said they would.

What about the investors that passed? Well this is the most surprising thing — they turned out to be exceedingly helpful. Any connections or intros we wanted? Done. Help with press connections? Done. We had one situation where we were having a first call with a new investor and unbeknownst to us he had already heard great things about us from an investor that passed. Every investor we have been in contact with has genuinely wanted to help us out and that's what I love about Silicon Valley and entrepreneurship in general. For example, we talked with a startup that pitched Andreessen Horowitz. They said that even though did not invest, it was the most pleasant experience they have ever had with an investor. Andreessen Horowitz focused on who the founders were, as people, for the first hour or two of their meeting.

Big thanks to everyone we chatted with during our fundraising process.

One important thing I learned: do everything you can to get a meeting with a partner, not an analyst.

It was just utterly unpredictable. Not to mention that fundraising before the holidays was probably not the best time to start.

Months In

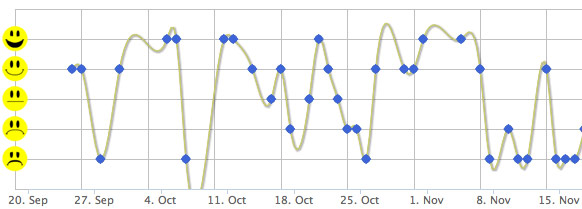

Before we started fundraising I began using Mercury App, a web app pings me everyday to record my feelings on a 1 to 5 scale. It's a simple decision making tool that we found because they integrated with Notifo for their beta users. As you can see, my mood was all over the place 6.

We had been at it for close to two months in when we took a step back and looked at the big picture. While we had raised more money, we realized it was coming close to killing the company it was trying to boost. We felt like crap as a result of not having actually built anything in a very long time. Did we really want to hire at this exact moment?

Everything you hear about startups is about raising millions, hiring tons of developers and growing fast. Are those the only conditions under which fast growth can occur? Can two insanely motivated developers and a caffeine IV7 get the job done?

Chad and I booked office hours at Y Combinator with Paul Graham one afternoon. We told him where we were with Notifo and the fundraising process. Paul quickly picked up on our distressed mannerisms, pointing out at one point that Chad and I had the same expression and stance throughout the meeting. Chad then took the opportunity to tell the story of a time when I picked him up to drive down to South Bay for an investor meeting and we happened to be wearing the exact same thing.

We talked financials a bit and PG suggested that we just cut off the fundraising round where it stood. PG offered two routes: optimizing for users or optimizing for revenue. We chose the latter.

It so happens our meeting was on the day Y Combinator announced Paul Buchheit and Harj Taggar coming on as partners

It so happens our meeting was on the day Y Combinator announced Paul Buchheit and Harj Taggar coming on as partners

Ultimately, Notifo is in the product/market fit phase of its growth. We have a great product and passionate user-base8 but we're still tinkering with the exact offering. It's best to stay small, nimble and agile at this point. We'll be keeping a keen eye on various Notifo metrics to see what we need to optimize and reaching out to current users and seeing how they use Notifo and what else they want out of it.

Optimize for Happiness

After this hectic fundraising process, Chad and I retreated to our office fort (my apartment) where we took out some expo markers and made a list of things that would make us happier in the day-to-day of the startup. Here is the complete, unedited list we made a month ago, not knowing it would ever be published:

- Coffee Maker

- Food supplies/drinks/snacks/booze

- Hackdays (never schedule meetings Monday or Friday)

- Notifo Apparel/Swag

- Meetups (get out in the community, partner with other startups and host developer drinkups)

- Livable Salaries

- Laptop (for Chad.. he has a deathly-slow first gen MBP)

- Coworking (work out of the apartment from time to time)

- Company Fieldtrips? (to clear our minds from time to time)

- Healthcare (I have a 5k deductible plan, and had to pay a clinic 150+ just to get a bad cough looked at)

What now?

Looking back on this process, I can only draw similarities between Rand Fishkin's (Co-Founder SEOmoz) post about his VC fundraising process:

Here’s my advice to other entrepreneurs, particularly in these irrationally exuberant times: Don’t start pitching until you’ve been pitched. ... The time I spent trying to raise a B round was the most wasteful 3+ months I’ve had at my job. Product was ignored; vision went unfulfilled; opportunity went unexecuted. Don’t make the same mistake – generate buzz with your success, your traction and press (PR is invaluable in the VC process – another big misstep we made). And let the investors come to you.

Chad and I are going to relax over the holidays and reset our brains. I'm going to the East Coast to play with my baby nephew (who was born at the same time as the iPhone 4 keynote!) and Chad is going on a cruise. When we return, we'll get back to hacking away on a new roadmap filled with long hours of productive coding, optimizing for revenue and keeping our users happy. We have more money in the bank than when we started and enough runway to make a difference.

While fundraising is an evil many startup entrepreneurs don't look forward to, I would say the hardest part of a startup is how you deal with advice. We have received conflicting advice on many aspects and challenges of our company. Knowing how to filter all the advice and not being taken over by happy ears is an important skill. I recently read the TechStars book, "Do More Faster", on my Kindle and thoroughly enjoyed it. There's a chapter that focuses on conflicting advice. There is also a section on the book that covers how we thought it was a race and that competitors we didn't even know existed were going to one day crush us and that's why we wanted to raise a bucket of money and hire quickly. And to get another perspective on things I am currently reading Start Small, Stay Small. While we're talking books here I also just finished reading I Will Teach You To Be Rich, which reminded me to buy some life-cycle funds when I can afford the minimum price.

Thoughts? Where are you with your startup?

Questions? Shoot me an email.

A big thanks to Paul Graham, Gabor Cselle, Harj Taggar, Jeff Miller and friends/family we've bugged many times for help during this process.

Footnotes

1 Can't skimp on the coffee machine.

2 We are now paying ourselves a modest stipend. Rent isn't cheap and my decrease in blogging here due to work has limited my monthly revenue which used to more than pay for rent.

3 Our primary metrics are notifications sent per day and number of services signed up

4 Relevant read: The New Funding Landscape by Paul Graham

5 Reminds me of "How I Screwed Up My Google Acquisition"

6 Most of my positive ones were because I was happy with a really awesome sandwich I made. "It's all in the sauce: How you can make cheap meat taste good" is the title of my cooking for startups book...

7 As of late I have been following along in Tim Ferriss's 4 Hour Body book and taking workout supplements like N.O.-Xplode that have high levels of caffeine, so that is my tea/coffee replacement for the time being.

8 One such user recently emailed us a drawing of a new feature he'd like to see

Related to Keep Calm & Carry On: Great post by Alexis Ohanian

Related to Keep Calm & Carry On: Great post by Alexis Ohanian